Invest in the future of residential real estate

Gain structured exposure to untapped home equity — and help homeowners achieve their financial goals — with flexible capital market solutions built for your portfolio.

~$2B+

portfolio of committed capital

20,000+

total investments

4.8

average from 5,000 reviews on Trustpilot

We believe that when you get more from homeownership, you get more from life

That’s why we built our home equity investment (HEI) platform: to help homeowners access their home equity without monthly payments. At the same time, investors reap the benefits of U.S. home price appreciation without the complexities that historically come with large-scale residential real estate investing. It’s a win-win.

Why invest with Hometap?

Top-tier team and service

- A scalable team of experienced finance professionals who understand the complexities of the market

- High-touch, high-quality service throughout the life of the partnership

- Seamless scaling of operations without compromising quality or service

Mission-driven company

- Homeowner-first mentality drives decision making

- Designed to help homeowners achieve financial stability and reach their goals without the burden of monthly payments

Proven track record

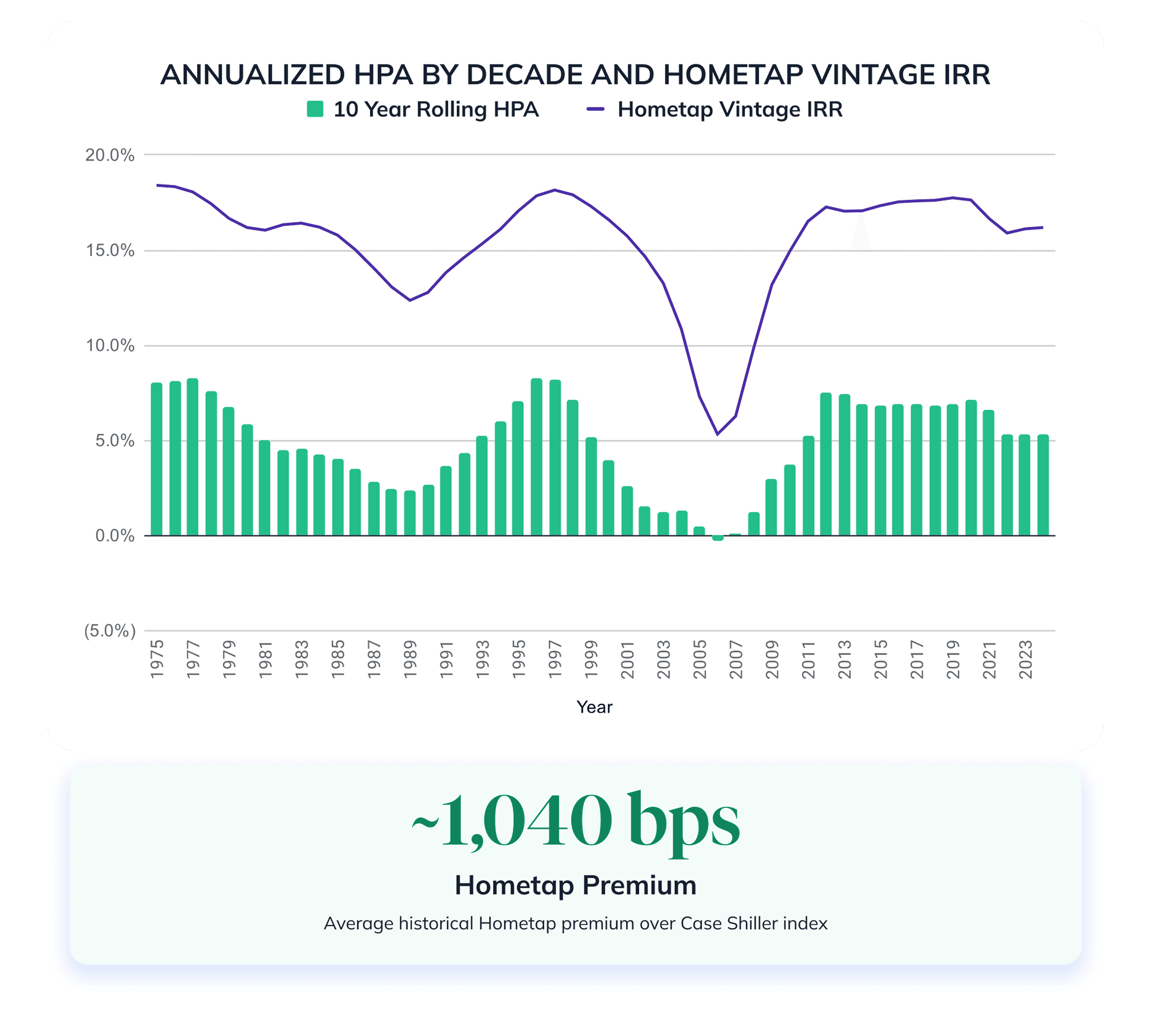

- 5+ years delivering strong, risk-adjusted returns vs. comparable asset classes

- Established securitization platform with consistent market execution and diverse investor participation

- 300+ person, tech-enabled organization that supports best-in-class execution

Flexible investment options

- Experience in structuring asset purchase facilities tailored to meet investor requirements, including forward flowa, managed funds, and SMAs

- Demonstrated capital markets execution capabilities, including rated and unrated loans, securities offerings, and other structured transactions

Unique product structure

- Portfolio-based risk sharing in both rising and declining home value environments

- Strong 2.2x Sharpe ratio

High-quality portfolio

- A combination of data science, technology, thorough underwriting creates high quality assets

- Rigorous and ongoing legal and compliance processes

Innovative product structure, proven track record

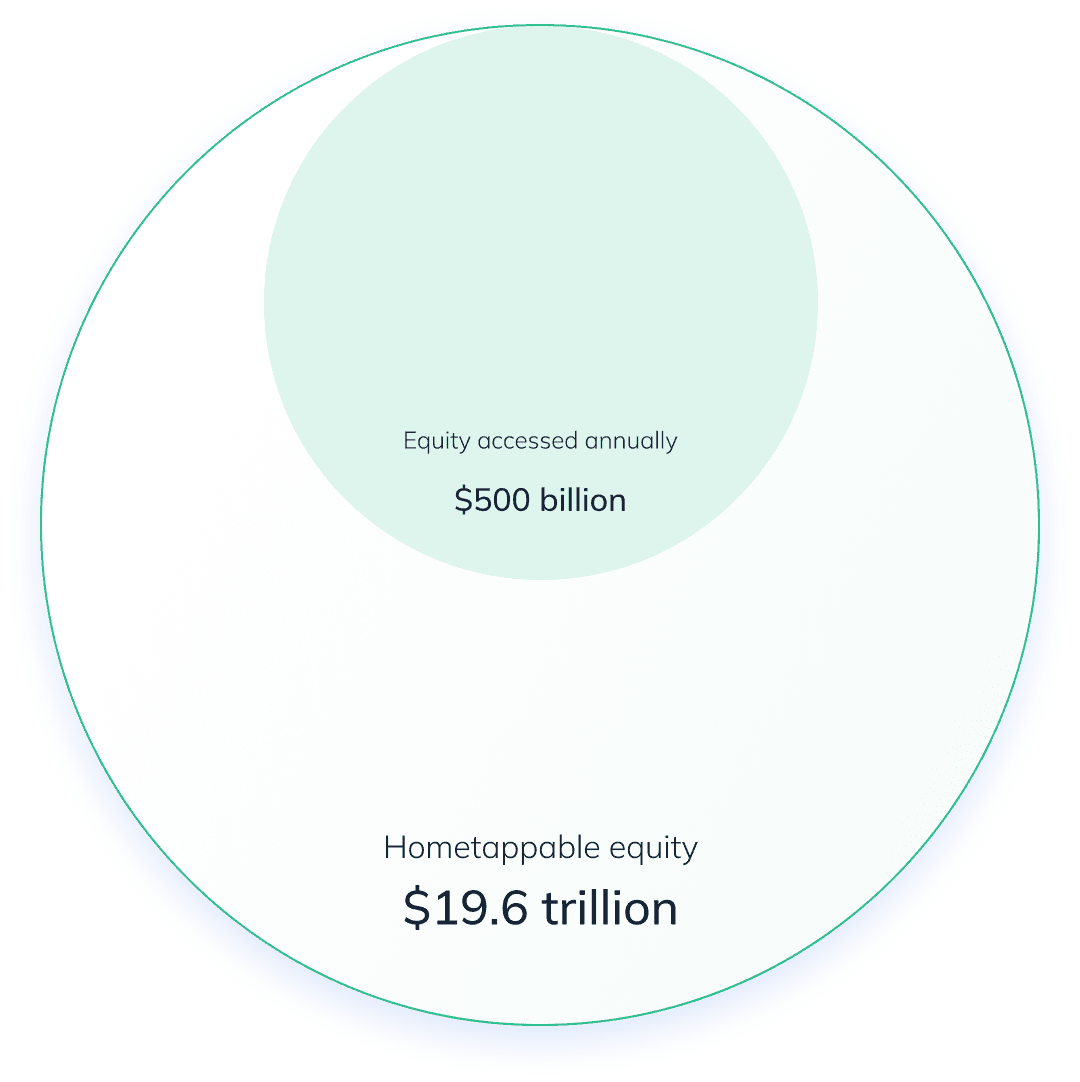

Sophisticated institutional investors — from large asset managers, credit funds, and insurance companies to family offices and individuals — can achieve diversified exposure to the multi-trillion dollar real estate market through Hometap’s investment vehicles and capital market solutions.

Learn about ways to invest

Hear from our investors

“We believe Hometap provides homeowners with a compelling financing alternative and investors with a diversified, attractive relative value way to make a long-term investment in U.S. residential assets.”

Get in touch

Ready to learn more about investing in Hometap? We'd love to connect.